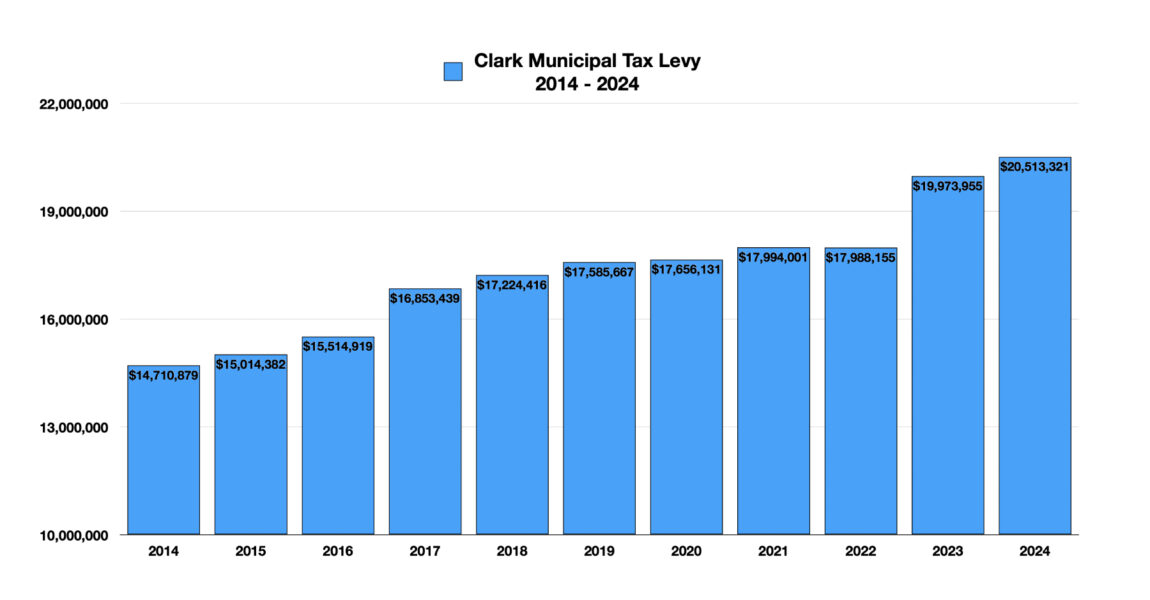

Clark’s Municipal Tax Levy has increased by $5,802,442 since 2014: a 39.4% increase

| Year | Tax Levy | % Increase |

|---|---|---|

| 2024 | $20,513,321 | 2.70% |

| 2023 | $19,973,955 | 11.04% |

| 2022 | $17,988,155 | -0.03% |

| 2021 | $17,994,001 | 1.91% |

| 2020 | $17,656,131 | 0.40% |

| 2019 | $17,585,667 | 2.10% |

| 2018 | $17,224,416 | 2.20% |

| 2017 | $16,853,439 | 8.63% |

| 2016 | $15,514,919 | 3.33% |

| 2015 | $15,014,382 | 2.06% |

| 2014 | $14,710,879 | N/A |

If the increases were 2% per year the increase would be $3,580,250.00 or 24.3%.

These numbers come from the clark township web site at: https://ourclark.com/153/Finance-Department

What is the Municipal Tax Levy?

The municipal tax levy is the total amount of money the town of Clark needs to raise from property taxes to pay for things like police, fire departments, fixing roads, and other services. Every year, the town council decides how much money is needed to cover all these costs.

How is the Municipal Tax Levy Different from Your Tax Bill?

While the municipal tax levy is the total amount the town needs to collect, your tax bill is just your portion of that total. How much you pay depends on how much your property is worth compared to other properties in town. So, while the municipal tax levy is about the town’s overall needs, your tax bill is specific to your property.

Your tax bill also includes other things like county taxes, school taxes, and a library tax, all added together to make up the total amount you have to pay each year.

Why the Municipal Tax Levy Goes Up

There are several reasons why the municipal tax levy might increase:

- Budget Needs: If the town needs more money to keep services running or to improve them, the tax levy might go up. This could be because of higher costs for things like worker salaries, materials, or new projects.

- Debt Payments: If the town has borrowed money for big projects, it has to pay back that money with interest, which can make the tax levy go up.

- State Aid: If the state government gives less money to the town, the town might need to increase the tax levy to make up for the difference.

- Inflation: As the prices of goods and services go up over time, the town needs more money to pay for the same things, which can increase the tax levy.

- Population Growth: More people in the town means more services are needed, which can make the tax levy go up.

How Misconduct Could Make the Levy Go Up

Besides the usual reasons, misconduct involving local government officials could also cause the municipal tax levy to increase.

- Legal Fees: The town might have to pay a lot of money for lawyers if people sue because of the misconduct.

- Settlements and Payouts: If the town is found responsible, it might have to pay people who were harmed, which can be very expensive.

- Reforms and Training: To fix the problems, the town might need to start new training programs or make changes in how things are done. This can cost money.

- Insurance Costs: After a scandal, the town’s insurance rates might go up because the insurance company sees the town as a bigger risk. Higher insurance costs mean the town needs more money to pay those bills.

- Loss of Revenue: If businesses or people don’t want to move to Clark because of the scandal, the town could lose money. To make up for it, they might need to raise the levy.

Managing the Municipal Tax Levy

The town council in Clark is responsible for managing the municipal tax levy. They look at the town’s needs and decide how much money is needed. The final budget is a balance between providing services and keeping taxes affordable. Understanding the municipal tax levy and how it affects your property taxes is important for everyone in Clark. By knowing what could cause the levy to increase, you can be prepared for changes in your tax bill. By getting involved in town meetings and staying informed about what’s happening, you can help make sure that the town government is working in the best interest of the community.