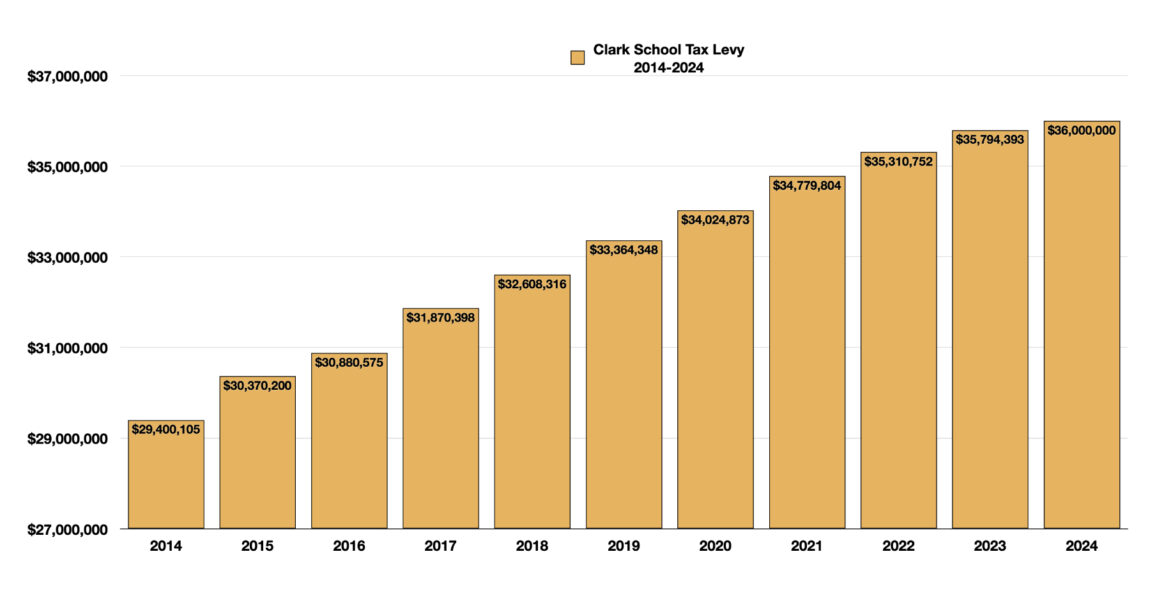

The school tax levy in Clark, NJ, is the amount of money that the local Board of Education collects from property taxes to fund the operations of the public schools in the district. This levy is a significant part of the overall property tax bill for residents and is calculated annually as part of the school budget process.

Trends in Clark’s School Budget

Since 2014 the Clark Schools tax levy has increased by $6,599,895 or about 22.4% which is in line with expected increases of about 2% per year.

| Year | Amount | % Increase |

|---|---|---|

| 2024 | $36,000,000* | 0.57% |

| 2023 | $35,794,393 | 1.37% |

| 2022 | $35,310,752 | 1.53% |

| 2021 | $34,779,804 | 2.22% |

| 2020 | $34,024,873 | 1.98% |

| 2019 | $33,364,348 | 2.32% |

| 2018 | $32,608,316 | 2.32% |

| 2017 | $31,870,398 | 3.21% |

| 2016 | $30,880,575 | 1.68% |

| 2015 | $30,370,200 | 3.30% |

| 2014 | $29,400,105 | N/A |

* 2024 value is an estimation by town of Clark in proposed budget

These numbers come from the clark township web site at: https://ourclark.com/153/Finance-Department

How the School Tax Levy is Calculated

School Budget Development:

-

- The process begins with the development of the school district’s budget, which outlines the projected expenses for the upcoming school year. This includes salaries and benefits for staff, utilities, supplies, transportation, maintenance, and any debt service on bonds for capital improvements.

Revenue Sources:

-

- The school budget is funded through a combination of state aid, federal funds, other local revenues, and the school tax levy. The levy is the amount needed to cover the budget after accounting for all other revenue sources.

Setting the Levy:

-

- Once the total budgetary needs are determined, the district calculates the levy by subtracting the anticipated revenue from state aid and other sources from the total budget. The remainder is what needs to be raised through property taxes.

Apportioning the Levy:

-

- The levy is then apportioned among property owners based on the assessed value of their properties. The local tax assessor determines each property’s assessed value, and the levy is distributed proportionally across all taxable properties.

Reasons for Levy Increases

Rising Operational Costs:

-

- If the costs of running the schools increase (e.g., due to salary increases, higher health insurance costs, or inflation), the levy may need to increase to cover these additional expenses.

Debt Service:

-

- If the district has taken on debt to fund capital improvements (e.g., building renovations, new school construction), the debt service payments could result in a higher levy.

Reduction in State Aid:

-

- If state aid is reduced, the district might need to increase the levy to make up the shortfall and maintain educational services.

Voter-Approved Initiatives:

-

- Sometimes, local voters approve additional spending on specific projects or initiatives, which can increase the levy.

What the Levy is Spent On

The school tax levy is spent on the following:

- Salaries and Benefits: The largest portion of the levy funds salaries and benefits for teachers, administrators, and support staff.

- Educational Programs: This includes funding for curriculum development, instructional materials, special education, and extracurricular activities.

- Facilities Maintenance: The levy covers the costs of maintaining and operating school buildings, including utilities, repairs, and security.

- Transportation: Funding for buses and transportation services for students is included.

- Debt Service: A portion of the levy may go toward paying off bonds issued for capital projects, such as new school buildings or major renovations.

Limits on Levy Increases

State Cap on Levy Increases:

-

- New Jersey law caps the annual increase in the school tax levy at 2% of the previous year’s levy. This cap is intended to limit the tax burden on residents and requires districts to manage their budgets within this constraint.

Exceptions to the Cap:

-

- Certain expenses are exempt from the 2% cap, such as increases in health insurance costs, certain pension contributions, and emergencies. If these costs rise, the district may increase the levy beyond 2% without requiring voter approval.

Voter Approval:

-

- If a district wants to increase the levy by more than the 2% cap for other reasons, it must seek approval from the voters through a referendum.