What Is the Library Tax?

The library tax is a portion of the municipal budget specifically allocated to fund the town’s public library. In 1985, the New Jersey Legislature enacted a law that required municipalities with established public libraries to allocate a minimum amount of funding for library services. By establishing a separate, dedicated tax specifically for libraries, the state ensures that funding for library services is not subject to the same pressures as other municipal budget items. This prevents libraries from competing with other municipal services (like police, fire, or public works) for funding, which could lead to underfunding, especially in tight budget years. This money is used for everything from buying books and paying staff to maintaining the library building and running community programs. The tax ensures that the library has the resources it needs to serve all residents.

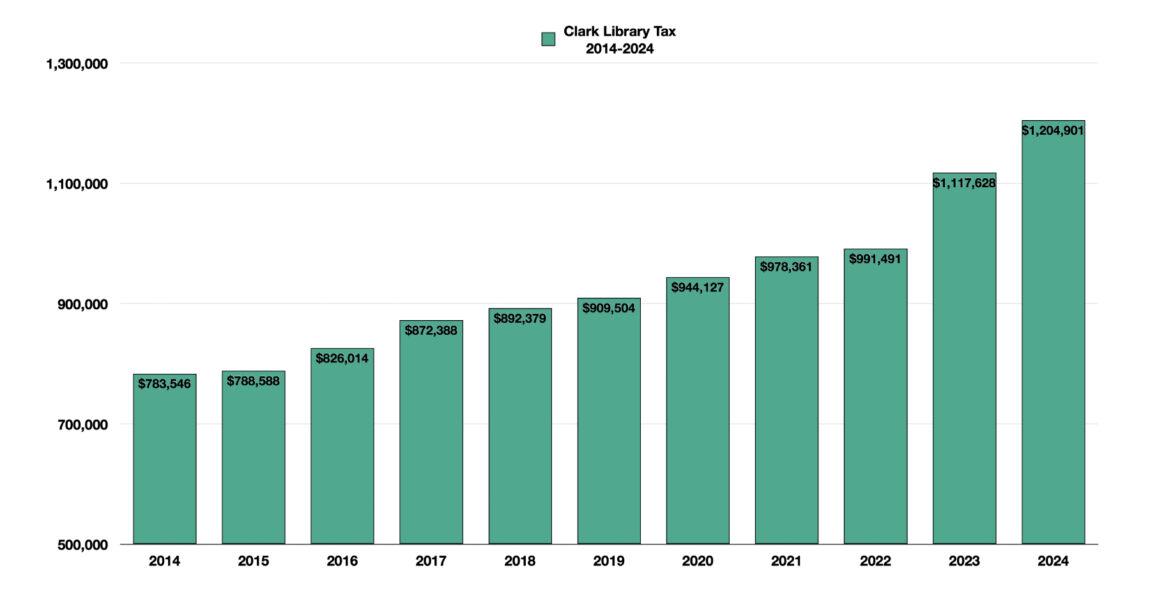

How Clark’s library tax has changed from 2014 to 2024:

| Year | Library Tax Amount | % Increase from Previous Year |

|---|---|---|

| 2024 | $1,204,901 | 7.8% |

| 2023 | $1,117,628 | 12.7% |

| 2022 | $991,491 | 1.3% |

| 2021 | $978,361 | 3.6% |

| 2020 | $944,127 | 3.8% |

| 2019 | $909,504 | 1.9% |

| 2018 | $892,379 | 2.3% |

| 2017 | $872,388 | 5.6% |

| 2016 | $826,014 | 4.7% |

| 2015 | $788,588 | 0.6% |

| 2014 | $783,546 | — |

This data comes from the budgets posted on the town of clark web site at: https://ourclark.com/153/Finance-Department

How Is the Library Tax Calculated?

The calculation of the library tax in New Jersey is governed by state law, specifically N.J.S.A. 40:54-8. This law requires each town to allocate a minimum amount of money for its library based on the town’s equalized assessed property value—not the regular assessed value.

Equalized assessed property value is a measure that adjusts the value of all taxable properties in the town to reflect their true market value. This adjustment is made using something called an equalization ratio, which helps ensure fairness across different towns by leveling the playing field in terms of property value assessments.

The library tax is calculated by multiplying the town’s equalized assessed property value by 1/3 of a mill (or 0.000333). This figure represents the minimum amount that the town must allocate to the library.

Here’s the formula:

Library Tax=Equalized Assessed Value×0.000333

So, if Clark’s total equalized assessed property value is $3 billion, the library tax would be:

Library Tax=$3,000,000,000×0.000333=$999,000

This $999,000 would be the minimum amount that Clark must allocate for the library that year.

Why Does the Library Tax Change?

The library tax amount changes primarily due to fluctuations in the town’s equalized assessed property value. As property values rise, the amount of money allocated to the library increases. This ensures that the library can keep up with inflation and growing community needs.

If property values were to decline, the library tax might decrease, though the law ensures that the library still receives a base level of funding.

Library Tax vs. Municipal Tax: What’s the Difference?

It’s important to understand that the library tax is different from the general municipal tax. While both are based on property values, they serve different purposes and are calculated differently:

- Library Tax: Specifically funds the library, calculated using the equalized assessed property value and a fixed formula (1/3 of a mill).

- Municipal Tax: Funds various other town services (e.g., police, fire, public works) and is based on the town’s budget needs and the assessed value of properties. The municipal tax rate can fluctuate based on budgetary requirements and political decisions.

Reasons for Increases:

- Library Tax: Increases mainly due to rising property values, ensuring that the library has enough funding to meet community needs.

- Municipal Tax: Increases might occur due to budget deficits, additional services, or infrastructure projects. These decisions are often made by local government and can vary from year to year.

The next time you visit the Clark Public Library, remember that the library tax is what helps keep the doors open, the bookshelves full, and the programs running—all contributing to a thriving community space for learning, exploration, and connection.